0DTE Blogs

0DTE Options Strategy: A Guide for Traders

0DTE Options Strategy: A Guide for Traders Options are contracts that give the buyer the right, but not the obligation, […]

Read More ›SPX 0DTE Trade Definitions

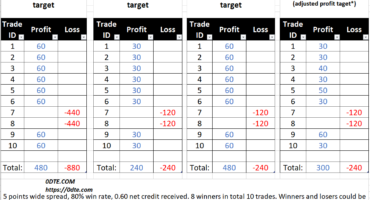

Credit: The net premium received when selling to open the credit spread. Credit = (Bidshort - Asklong) * 100 Max. Loss: […]

Read More ›S&P 500 Index Options - SPX

Cboe’s SPX® options products provide investors with the tools to gain efficient exposure to the U.S. equity market and execute risk […]

Read More ›Mini-SPX Index Options (XSP)

The Cboe Mini-SPX option contract, known by its symbol XSP, is an index option product designed to track the underlying […]

Read More ›SPX 0DTE strategy

What is SPX 0DTE strategy? SPX weekly options that expire on every Monday, Wednesday and Friday we trade them on […]

Read More ›Strategies

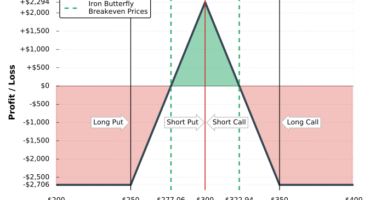

Jim Olson Iron Butterfly 0DTE Trade Plan

Iron Butterfly involves selling the ATM call and put and buying wings. Sell the Open in the first 1 minute. […]

Read More ›Vertical Spread - 0 DTE

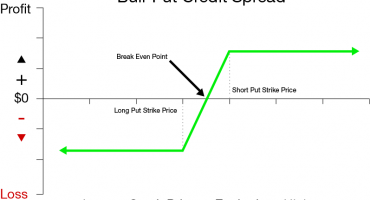

Vertical Spread Long Call Vertical Spread A long call vertical spread is a bullish, defined risk strategy made up of […]

Read More ›Iron Condor - 0 DTE

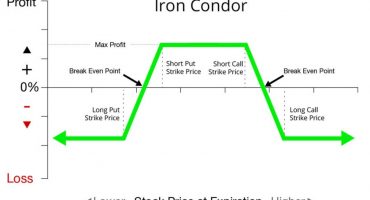

Iron Condor An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a […]

Read More ›