Iron Condor – 0 DTE

Iron Condor

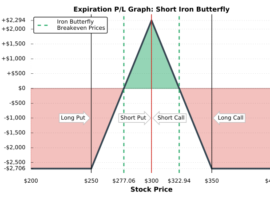

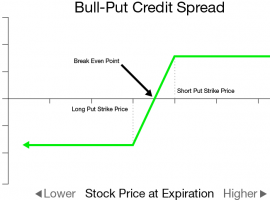

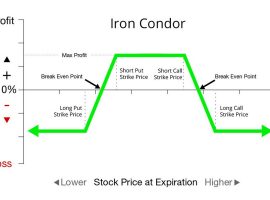

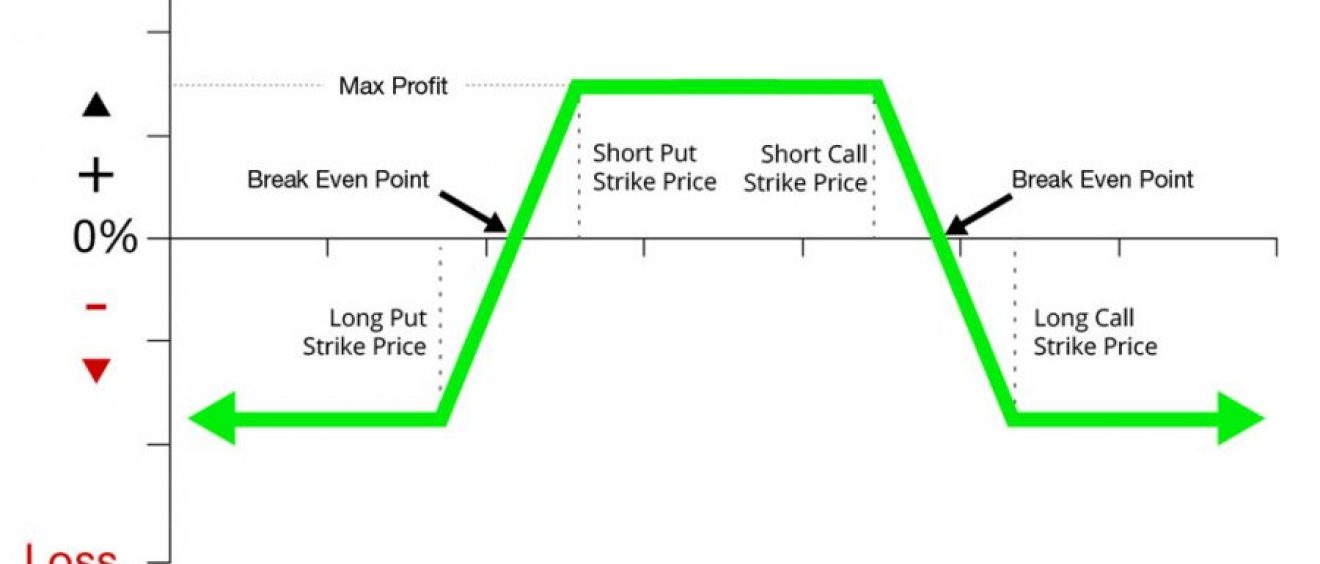

An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. It benefits from the passage of time and any decreases in implied volatility.

Directional Assumption: Neutral

Setup:

– Sell OTM Call Vertical Spread

– Sell OTM Put Vertical Spread

Ideal Implied Volatility Environment : High

Max Profit: The maximum profit potential for an Iron Condor is the net credit received. Maximum profit is realized when the underlying settles between the short strikes of the trade at expiration.

How to Calculate Breakeven(s):

– Upside: Short Call Strike + Credit Received

– Downside: Short Put Strike – Credit Received

tips:

When do we close Iron Condors?

Much like other standard premium selling strategies, we close iron condors when we reach 50% of our max profit. This can increase our win rate over time, as we are taking risk off the table and locking in profits.

When do we manage Iron Condors?

We manage iron condors by adjusting the untested side, or profitable side of the spread. We look to roll the untested spread closer to the stock price to collect more premium. We can go as far as rolling our untested spread to the same short strike as our tested spread, which creates an iron fly.