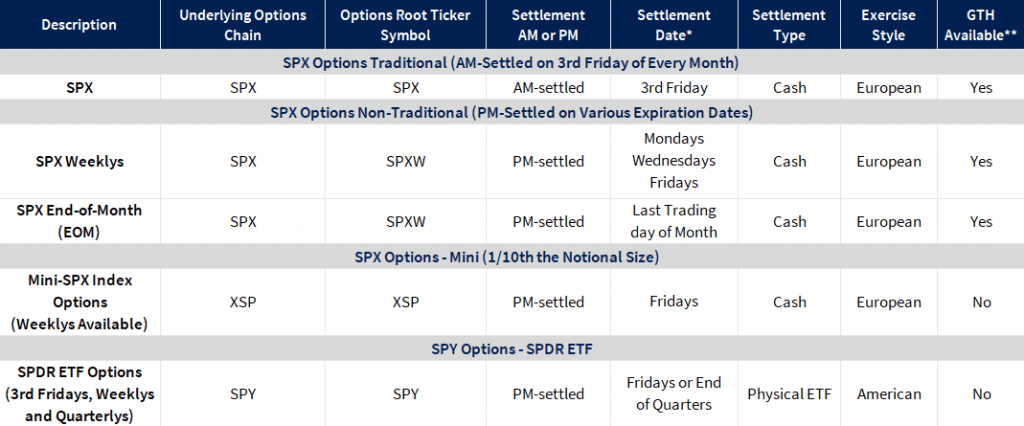

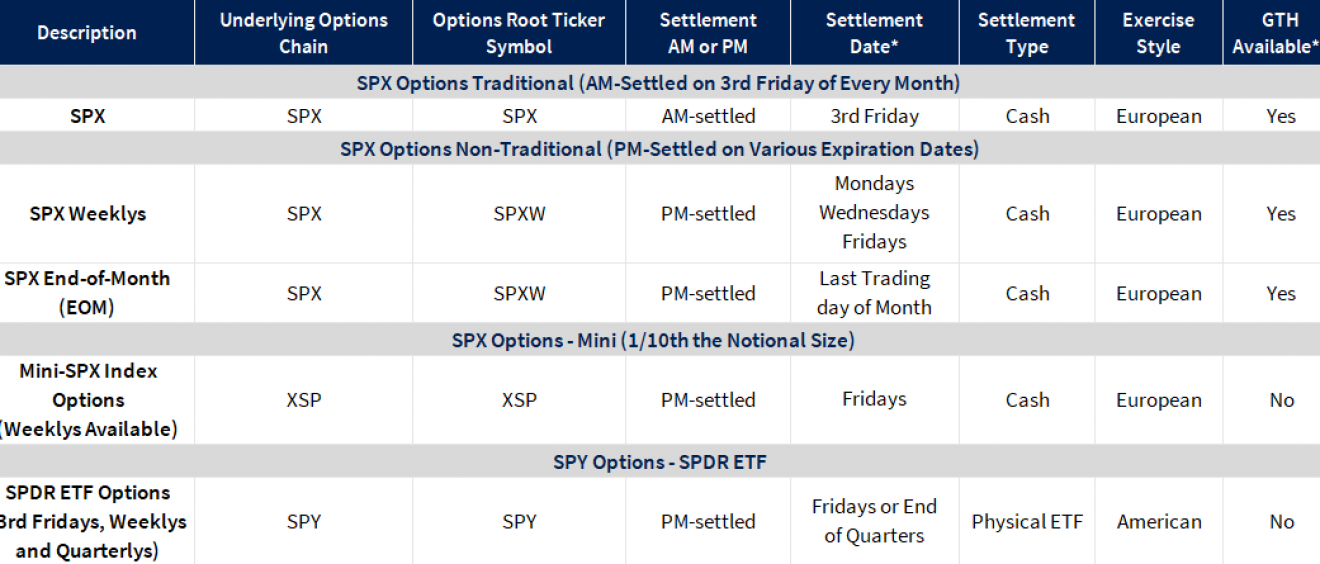

S&P 500 Index Options – SPX

Cboe’s SPX®xa0options products provide investors with the tools to gain efficient exposure to the U.S. equity market and execute risk management, hedging, asset allocation, and income generation strategies.

Symbol:

SPX

Underlying:

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks from a broad range of industries. The component stocks are weighted according to the total market value of their outstanding shares. The impact of a component’s price change is proportional to the issue’s total market value, which is the share price times the number of shares outstanding. These are summed for all 500 stocks and divided by a predetermined base value. The base value for the S&P 500 Index is adjusted to reflect changes in capitalization resulting from mergers, acquisitions, stock rights, substitutions, etc.

Multiplier:

$100.

Premium Quote:

Stated in decimals. One point equals $100. Minimum tick for options trading below 3.00 is 0.05 ($5.00) and for all other series, 0.10 ($10.00).

Strike Prices:

In-,at- and out-of-the-money strike prices are initially listed. New series are generally added when the underlying trades through the highest or lowest strike price available.

Strike Price Intervals:

Five points. 25-point intervals for far months.

Expiration Months:

Up to twelve (12) near-term months. In addition, the Exchange may list up to ten (10) SPX LEAPS® expiration months that expire from 12 to 60 months from the date of issuance.

Expiration Date:

The third Friday of the expiration month.

Exercise Style:

European – SPX options generally may be exercised only on the expiration date.

Last Trading Day:

Trading in SPX options will ordinarily cease on the business day (usually a Thursday) preceding the day on which the exercise-settlement value is calculated.

Settlement Value:

Exercise will result in delivery of cash on the business day following expiration. The exercise-settlement value, SET, is calculated using the opening sales price in the primary market of each component security on the expiration date. The exercise-settlement amount is equal to the difference between the exercise-settlement value and the exercise price of the option, multiplied by $100.

Position and Exercise Limits:

No position and exercise limits are in effect.

Margin:

Purchases of puts or calls with 9 months or less until expiration must be paid for in full. Writers of uncovered puts or calls must deposit / maintain 100% of the option proceeds* plus 15% of the aggregate contract value (current index level x $100) minus the amount by which the option is out-of-the-money, if any, subject to a minimum for calls of option proceeds* plus 10% of the aggregate contract value and a minimum for puts of option proceeds* plus 10% of the aggregate exercise price amount. (*For calculating maintenance margin, use option current market value instead of option proceeds.) Additional margin may be required pursuant to Exchange Rule 12.10.

Cusip Number:

648815

Trading Hours:

Extended Hours: 2:00 a.m. to 8:15 a.m. Central time (Chicago time).

Regular Hours: 8:30 a.m. to 3:15 p.m. Central time (Chicago time).