0DTE Options Strategy: A Guide for Traders

0DTE Options Strategy: A Guide for Traders

Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price and time. Options can be used for various purposes, such as hedging, speculation, income generation, or portfolio diversification.

One of the factors that affect the value of an option is time decay. Time decay is the decrease in the option’s price as it approaches its expiration date. The closer the option is to expiration, the faster it loses value due to time decay.

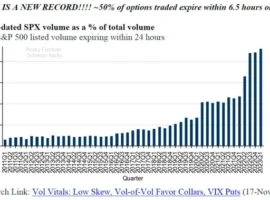

Some traders use a strategy called 0DTE options, which stands for zero days to expiration. This means that they buy or sell options on the same day that they expire. This strategy can be risky, but also potentially profitable, depending on the market conditions and the trader’s skill.

The main advantage of 0DTE options is that they are very cheap compared to longer-term options. This means that traders can use a small amount of capital to gain exposure to a large number of underlying assets. For example, if a stock is trading at $100 and a 0DTE call option with a strike price of $101 costs $0.01, then a trader can buy 100 contracts for $100 and control 10,000 shares of the stock.

The main disadvantage of 0DTE options is that they have a very low probability of success. Most of the time, the options will expire worthless or with minimal value, resulting in a loss for the trader. The trader needs to be very accurate in predicting the direction and magnitude of the price movement of the underlying asset in order to make a profit.

Another challenge of 0DTE options is that they are subject to high volatility and liquidity risk. Volatility is the measure of how much the price of an asset fluctuates over time. Liquidity is the measure of how easily an asset can be bought or sold without affecting its price. High volatility and low liquidity can make it difficult for traders to enter or exit their positions at favorable prices.

Therefore, 0DTE options are not suitable for beginners or risk-averse traders. They require a lot of experience, discipline, and market knowledge to execute successfully. Traders who use this strategy should have a clear trading plan, a strict risk management system, and a well-defined exit strategy.

0DTE options can be an exciting and rewarding way to trade options, but they also come with significant risks and challenges. Traders who are interested in this strategy should do their own research, practice on a demo account, and start with small positions until they gain confidence and skill.