Jim Olson Iron Butterfly 0DTE Trade Plan

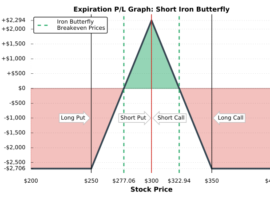

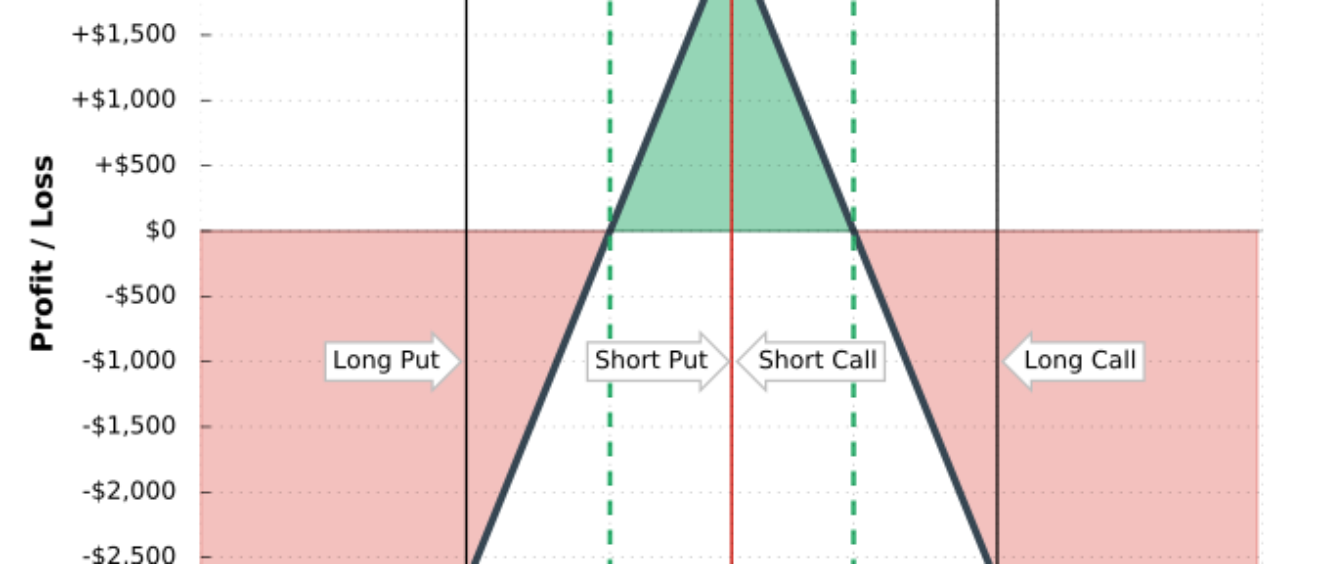

Iron Butterfly involves selling the ATM call and put and buying wings.

Sell the Open in the first 1 minute. The official open price for SPX is almost never accurate because all 500 stocks don’t immediately have bid at open. I wait 10 – 15 seconds after open to see where SPX is trading. This is the price I use to determine the strike I’m going to sell. I never try to guess direction with the Iron Fly. If SPX is trading at 3102.50, I would do $3100 or $3105. I would never do further out and try to guess the direction of the market. I don’t care what indicators you use. Price action is all that matters and will always win. By selling the open the most premium decay will happen in the first 30 minutes regardless of the IV environment.

SPX options start trading at 3 AM Eastern. They stop from 9:15 to 9:30. At 9 AM I start looking at the options to see where we are trading at. I look at what the Implied Move for the day is. I look at see what type of credit I can get. If the Implied Move is under $30, I will simply use $50 wings. If the Implied Move is over $30 you will need to increase the wing size so you can get out of the trade faster. The more money you pay for the wings the longer you will stay in the trade. Never look at the options from 9:15 to 9:30 because the option prices will be messed up.

Example on June 15th 2020

The ATM $2980 Call and Put was ~ $45.50 at the open.

$50 Wings $2930/2980/3030 the credit is $33.80. So the Wings cost you $11.70

$60 Wings $2920/2980/3040 the credit is $37.15. So the Wings cost you $8.35

$70 Wings $2910/2980/3050 the credit is $39.70. So the Wings cost you $5.80

$80 Wings $2900/2980/3060 the credit is $41.25. So the Wings cost you $4.25

$90 Wings $2890/2980/3070 the credit is $42.55. So the Wings cost you $2.95

$100 Wings $2880/2980/3080 the credit is $43.50. So the Wings cost you $2.00

My general guideline is to keep increasing the wing size by $10 until you stop receiving at least a $1.00 extra credit. So in the example above I would you $80 wings. In my opinion it isn’t worth it to go $10 wider from $90 wings to $100 wings to collect $.95.

I am currently using TOS to trade so I’ll walk through a trade. I open the Trade tab and type in SPX. I pull up the 0-DTE option chain. I changed the Spread to Single. Now you can simply hold down the ctrl key and select the strikes you would like. You select the bid side to sell the strike and select the ask side to buy the strike. If you like to use the App turn the Spread to Custom to easily select the strikes you want.

Example from June 21, 2020

At 9:30:30 SPX was trading at $3150.47. So lets sell the $3150 call and put and buy the $3200 call and $3100 put. The mid price is showing a $20.85. I would leave it at the mid price and confirm and send the order. If you don’t get filled in the first minute lower the price by $.10 and send the order again. I usually wait 1 minute before changing the order again. Lets assume we got filled at the $20.85. I always use a limit order to get in and I never lag in. Please note the Break Even Stock Prices (3129.75 / 3170.85) are the prices I use for my stop loss.

Profit Target is $1.50. So $20.85 – $1.50 = $19.35. So I would set my buy order for $19.35.

My stop loss criteria simply the break even stock price. After I get filled I will draw a price line on my chart with $3129.15 and $3170.85. With TOS you can also set a conditional order based on SPX price.

So lets walk through placing a OCO trade. One order will be a buy order to take profit, the other order will be a order to take you out if SPX crosses $3129.15 or $3170.85.

First make a limit order to buy back at $19.35 Then select advanced order and change to OCO.

Click on the first order and select create duplicate order. Change this order to market. Then select the gear icon.

This will open a new screen where you can enter conditions. Put the Symbol to SPX, Method Mark, Trigger >= $3170.85

You can enter another one for SPX with the opposite for $3129.15 Enter Save and then you are ready to confirm and send the order.

Double check on the Order Confirmation page with the conditions to make sure they are right.

How to determine if you can hold of more of a profit. First, I would recommend taking ½ off at the $1.50 target. Look at the current chart with a 30 min candle setting. Compare what the range of the first 30 minutes is. If the range is $10 and you received a $20.85 credit this will increase the rate the ATM options are decaying. If I hold for more profit, I still like to be out by 11 AM Eastern. There is a lack of decay with this strategy from 12pm to 3pm Eastern.

If I get stopped out, I usually enter another Iron Fly near the area I was stopped out. I still keep my $1.50 profit target. The second Iron Fly is simply to help reduce my loss for the day.

Don’t get Greedy!! Remember Base Hits win baseball games. The same is true for portfolio over the long run.

Tips

#1 Don’t watch the P/L while in the trade. It is very jumpy the first 15 minutes.

#2 Don’t use TOS to paper trade it. It will give you bullshit fills that you would never get in real life. Instead I recommend just watching the mid price of the trade. To get out you need to see the mid price go past $.15 to $.20 your exit price. This way it is more realistic unlike TOS paper.

#3 Ondemand feature is horrible for this strategy.

#4 Always have the profit order out and sitting. Market changes are very fast.

#5 The wider the wings the better. See my comments above on how I usually increase my wings with the increase in Implied Move.

#6 If you are getting tested near your stop point I will often change my exit to a smaller profit target or even the credit received.

#7 Never ever lag out of this trade. I promise you that you will probably just make it worse.

#8 After 1 hour in the trade if you are underwater, I would consider changing my exit order. If you didn’t hit profit in the first hour your odds are no longer in your favor.

Credit: Jim Olson (Not me).