SPX 0DTE strategy

What is SPX 0DTE strategy?

SPX weekly options that expire on every Monday, Wednesday and Friday we trade them on the day it expires. So, there is no overnight risk. Usually we open a credit spread when the market open around 9:30 A.M EST, and we close the trade before market close same day around 4:00 P.M EST. That is why it is called 0DTE, AKA same day option trade.

Why 0DTE strategy?

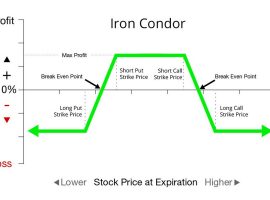

1. Can Profit if SPX increase, decrease, or doesn’t move at all. (High probability of making money)

2. Limited loss potential. Never worry about “blowing up” when the market makes a huge move (assuming appropriate position size)

3. Very simple strategy. The two primary credit spread strategies only have two components.

4. Consistent daily/weekly income. (why i started trading this strategy personally 🙂 )

What is SPX?

SPX, or the Standard & Poor’s 500 Index, is a stock index based on the 500 largest companies with shares listed for trading on the NYSE or NASDAQ. The term “largest” refers to each firm’s market capitalization or its stock price multiplied by the number of shares it has outstanding.

The SPX itself may not trade, but both futures contracts and options certainly do.

Why SPX?

1. SPX Options expire on every Monday, Wednesday and Friday.

2. SPX pays no Dividend.

3. SPX Cash Settled when the market closes at 4:00 P.M EST.

No risk of early assignment and loss of dividends, no portfolio disruption on assignment.

What is a Credit Spread?

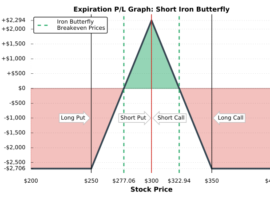

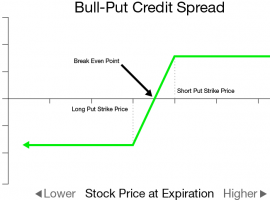

A credit spread where we sell an option at one strike and simultaneously buy an option at another. The way we use this in the SPX Spread Trader is to use a 5 pt spread between the 2 strike prices. So if we are selling a 3100 call we are purchasing a 3105 call at the same time. By entering these two trades as a single credit spread order, there is only a single commission cost. The difference in prices between these two options provides a net credit to your account. The beauty of this approach, is that there is no price movement in the SPX required to be profitable. SPX can go flat or have little movement at all, and our trade will still be profitable. All we need is for the SPX to close below 3100 (in this example), and both options will expire worthless and we retain the credit.

SELL TO OPEN -1 SPX NOV 15 2019 3100 CALL

BUY TO OPEN +1 SPX NOV 15 2019 3105 CALL

Net credit of $0.60. max loss:$4.40

in this example, we are investing $500 to open a bear call spread, receiving $60, and risking $440. as long as SPX stays below 3100 at 4:00p.m. EST, we will keep $60.

Most of the time, we don’t wait till market close. We close the trade at 50-60% profit target, and 2-2.5X credit stop loss.

in this example, we would close it for $0.20. So, we would make 0.60-0.20=$0.40 profit. OR, we would stopped out at $1.50 which is at 1.50-0.60=$90 loss.

6%

Avg Returns / Trade

* $30 (profit) / $500 (investment)

50%

Profit Target

* 0.60 (credit received) x 0.5 = 0.30 (profit)

2x – 2.5x

STOP LOSS

* 0.60 credit received x 2.5 = 1.5 (stop loss) – 0.60 (credit received) = 0.90 (net loss 🙁 )