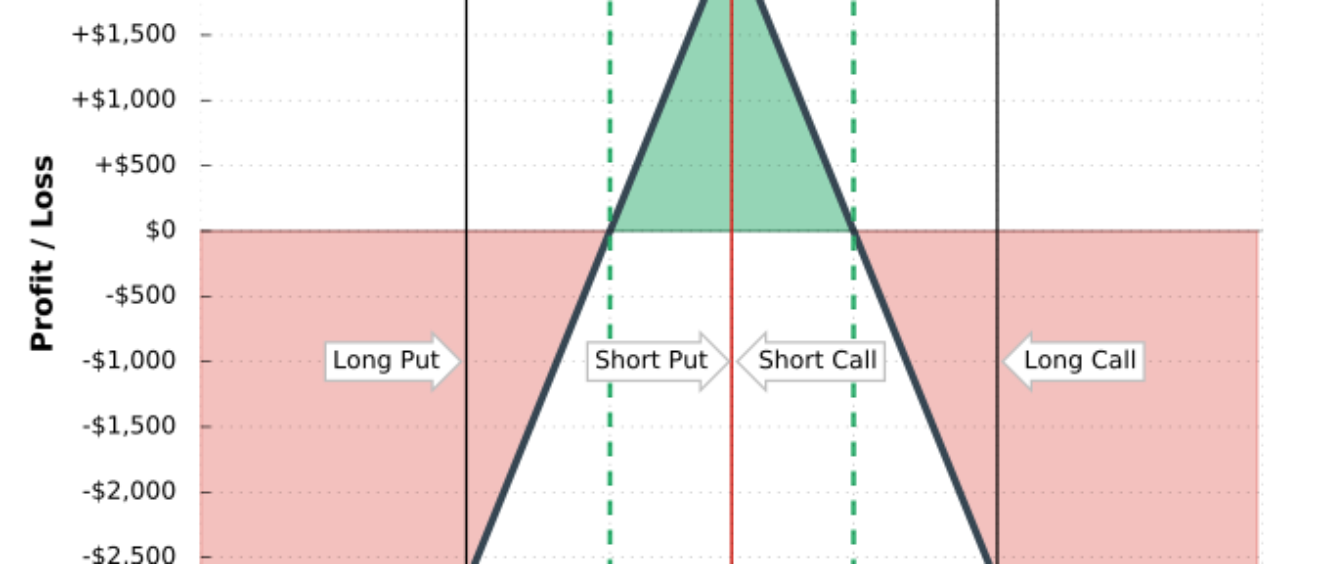

Iron Butterfly involves selling the ATM call and put and buying wings.

Sell the Open in the first 1 minute. The official open price for SPX is almost never accurate because all 500 stocks don’t immediately have bid at open. I wait 10 – 15 seconds after open to see where SPX is trading. This is the price I use to determine the strike I’m going to sell. I never try to guess direction with the Iron Fly. If SPX is trading at 3102.50, I would do $3100 or $3105. I would never do further out and try to guess the direction of the market. I don’t care what indicators you use. Price action is all that matters and will always win. By selling the open the most premium decay will happen in the first 30 minutes regardless of the IV environment.

SPX options start trading at 3 AM Eastern. They stop from 9:15 to 9:30. At 9 AM I start looking at the options to see where we are trading at. I look at what the Implied Move for the day is. I look at see what type of credit I can get. If the Implied Move is under $30, I will simply use $50 wings. If the Implied Move is over $30 you will need to increase the wing size so you can get out of the trade faster. The more money you pay for the wings the longer you will stay in the trade. Never look at the options from 9:15 to 9:30 because the option prices will be messed up.

Example on June 15th 2020

The ATM $2980 Call and Put was ~ $45.50 at the open.

$50 Wings $2930/2980/3030 the credit is $33.80. So the Wings cost you $11.70

$60 Wings $2920/2980/3040 the credit is $37.15. So the Wings cost you $8.35

$70 Wings $2910/2980/3050 the credit is $39.70. So the Wings cost you $5.80

$80 Wings $2900/2980/3060 the credit is $41.25. So the Wings cost you $4.25

$90 Wings $2890/2980/3070 the credit is $42.55. So the Wings cost you $2.95

$100 Wings $2880/2980/3080 the credit is $43.50. So the Wings cost you $2.00

My general guideline is to keep increasing the wing size by $10 until you stop receiving at least a $1.00 extra credit. So in the example above I would you $80 wings. In my opinion it isn’t worth it to go $10 wider from $90 wings to $100 wings to collect $.95.

I am currently using TOS to trade so I’ll walk through a trade. I open the Trade tab and type in SPX. I pull up the 0-DTE option chain. I changed the Spread to Single. Now you can simply hold down the ctrl key and select the strikes you would like. You select the bid side to sell the strike and select the ask side to buy the strike. If you like to use the App turn the Spread to Custom to easily select the strikes you want.

Example from June 21, 2020

At 9:30:30 SPX was trading at $3150.47. So lets sell the $3150 call and put and buy the $3200 call and $3100 put. The mid price is showing a $20.85. I would leave it at the mid price and confirm and send the order. If you don’t get filled in the first minute lower the price by $.10 and send the order again. I usually wait 1 minute before changing the order again. Lets assume we got filled at the $20.85. I always use a limit order to get in and I never lag in. Please note the Break Even Stock Prices (3129.75 / 3170.85) are the prices I use for my stop loss.

Profit Target is $1.50. So $20.85 – $1.50 = $19.35. So I would set my buy order for $19.35.

My stop loss criteria simply the break even stock price. After I get filled I will draw a price line on my chart with $3129.15 and $3170.85. With TOS you can also set a conditional order based on SPX price.

So lets walk through placing a OCO trade. One order will be a buy order to take profit, the other order will be a order to take you out if SPX crosses $3129.15 or $3170.85.

First make a limit order to buy back at $19.35 Then select advanced order and change to OCO.

Click on the first order and select create duplicate order. Change this order to market. Then select the gear icon.

This will open a new screen where you can enter conditions. Put the Symbol to SPX, Method Mark, Trigger >= $3170.85

You can enter another one for SPX with the opposite for $3129.15 Enter Save and then you are ready to confirm and send the order.

Double check on the Order Confirmation page with the conditions to make sure they are right.

How to determine if you can hold of more of a profit. First, I would recommend taking ½ off at the $1.50 target. Look at the current chart with a 30 min candle setting. Compare what the range of the first 30 minutes is. If the range is $10 and you received a $20.85 credit this will increase the rate the ATM options are decaying. If I hold for more profit, I still like to be out by 11 AM Eastern. There is a lack of decay with this strategy from 12pm to 3pm Eastern.

If I get stopped out, I usually enter another Iron Fly near the area I was stopped out. I still keep my $1.50 profit target. The second Iron Fly is simply to help reduce my loss for the day.

Don’t get Greedy!! Remember Base Hits win baseball games. The same is true for portfolio over the long run.

Tips

#1 Don’t watch the P/L while in the trade. It is very jumpy the first 15 minutes.

#2 Don’t use TOS to paper trade it. It will give you bullshit fills that you would never get in real life. Instead I recommend just watching the mid price of the trade. To get out you need to see the mid price go past $.15 to $.20 your exit price. This way it is more realistic unlike TOS paper.

#3 Ondemand feature is horrible for this strategy.

#4 Always have the profit order out and sitting. Market changes are very fast.

#5 The wider the wings the better. See my comments above on how I usually increase my wings with the increase in Implied Move.

#6 If you are getting tested near your stop point I will often change my exit to a smaller profit target or even the credit received.

#7 Never ever lag out of this trade. I promise you that you will probably just make it worse.

#8 After 1 hour in the trade if you are underwater, I would consider changing my exit order. If you didn’t hit profit in the first hour your odds are no longer in your favor.

Credit: Jim Olson (Not me).

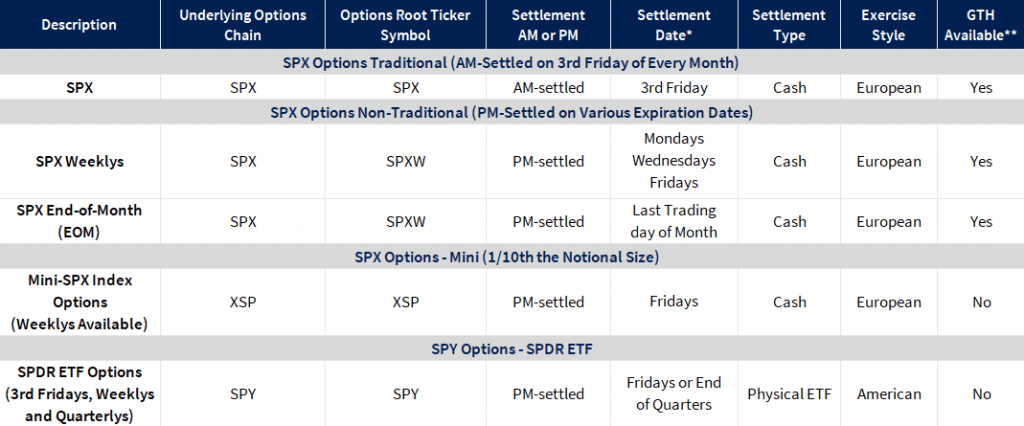

Cboe’s SPX® options products provide investors with the tools to gain efficient exposure to the U.S. equity market and execute risk management, hedging, asset allocation, and income generation strategies.

Symbol:

SPX

Underlying:

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks from a broad range of industries. The component stocks are weighted according to the total market value of their outstanding shares. The impact of a component’s price change is proportional to the issue’s total market value, which is the share price times the number of shares outstanding. These are summed for all 500 stocks and divided by a predetermined base value. The base value for the S&P 500 Index is adjusted to reflect changes in capitalization resulting from mergers, acquisitions, stock rights, substitutions, etc.

Multiplier:

$100.

Premium Quote:

Stated in decimals. One point equals $100. Minimum tick for options trading below 3.00 is 0.05 ($5.00) and for all other series, 0.10 ($10.00).

Strike Prices:

In-,at- and out-of-the-money strike prices are initially listed. New series are generally added when the underlying trades through the highest or lowest strike price available.

Strike Price Intervals:

Five points. 25-point intervals for far months.

Expiration Months:

Up to twelve (12) near-term months. In addition, the Exchange may list up to ten (10) SPX LEAPS® expiration months that expire from 12 to 60 months from the date of issuance.

Expiration Date:

The third Friday of the expiration month.

Exercise Style:

European – SPX options generally may be exercised only on the expiration date.

Last Trading Day:

Trading in SPX options will ordinarily cease on the business day (usually a Thursday) preceding the day on which the exercise-settlement value is calculated.

Settlement Value:

Exercise will result in delivery of cash on the business day following expiration. The exercise-settlement value, SET, is calculated using the opening sales price in the primary market of each component security on the expiration date. The exercise-settlement amount is equal to the difference between the exercise-settlement value and the exercise price of the option, multiplied by $100.

Position and Exercise Limits:

No position and exercise limits are in effect.

Margin:

Purchases of puts or calls with 9 months or less until expiration must be paid for in full. Writers of uncovered puts or calls must deposit / maintain 100% of the option proceeds* plus 15% of the aggregate contract value (current index level x $100) minus the amount by which the option is out-of-the-money, if any, subject to a minimum for calls of option proceeds* plus 10% of the aggregate contract value and a minimum for puts of option proceeds* plus 10% of the aggregate exercise price amount. (*For calculating maintenance margin, use option current market value instead of option proceeds.) Additional margin may be required pursuant to Exchange Rule 12.10.

Cusip Number:

648815

Trading Hours:

Extended Hours: 2:00 a.m. to 8:15 a.m. Central time (Chicago time).

Regular Hours: 8:30 a.m. to 3:15 p.m. Central time (Chicago time).

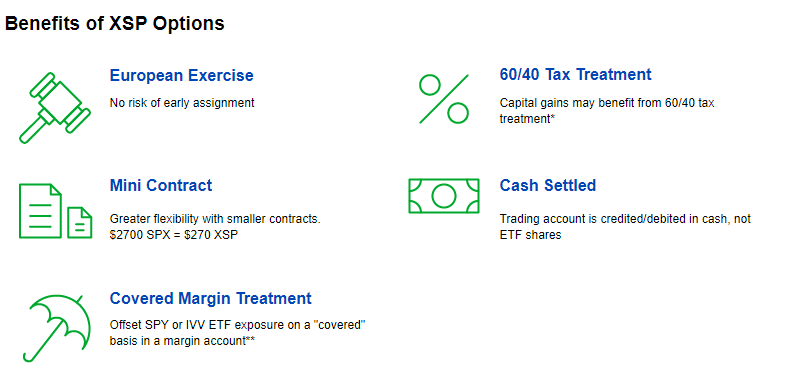

The Cboe Mini-SPX option contract, known by its symbol XSP, is an index option product designed to track the underlying S&P 500 Index. At 1/10 the size of the standard SPX options contract, XSP provides greater flexibility for new index options traders or traders managing an individual portfolio.

XSP Weekly Options

Whether it’s trading around specific events, such as earnings announcements or economic data reports, or executing overwriting or spread-trading strategies, Cboe XSP weekly options allow traders the granularity to more closely tailor their trades to meet their needs. And for traders executing premium collection strategies, XSP weekly options provide the opportunity to collect premium 52 times per year rather than 12.

XSP weekly options are offered with Monday, Wednesday, and Friday settlements. For Friday settlements, options contract expirations occur on non-standard Friday expirations throughout the year. Similarly, Monday and Wednesday XSP Weeklys options settlements may expire on any Monday or Wednesday of the month, other than a Monday or Wednesday that coincides with an end-of-month expiration date.

XSP Monday, Wednesday and Friday Weeklys options are typically listed on Friday, Tuesday and Thursday, respectively and will expire on their expiration date. If a standard or EOM options contract settlement exists in a week that coincides with a typical Weekly expiration date, a Weekly expiration will not exist on that expiration day. (The term Weeklys refers to the fact that the contracts are listed every week, not that they are a seven-day contract). Settlement processes for XSP weeklys are the same as their standard options counterparts (index, ETF, etc.).

Trading XSP

XSP options trade on Cboe’s Hybrid Trading System, which provides investors with the combined advantages of electronic trading and an open-outcry market on a single platform. XSP options also trade on the EDGX exchange.

XSP Options Product Specifications

Symbol: XSP

Underlying:

The Mini-SPX Index, based on 1/10th the value of the Standard & Poor’s 500 Index (SPX). The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks from a broad range of industries. The component stocks are weighted according to the total market value of their outstanding “free float” shares.

Multiplier:

$100.

Strike Price Intervals:

Generally, $1 or greater where the strike price is $200 or less and $5.00 or greater where the strike price is greater than $200. For XSP weekly contracts, the lowest strike price interval Cboe may list is $0.50.

Strike (Exercise) Prices:

In-, at- and out-of-the-money strike prices are initially listed. New strikes can be added as the index moves up or down.

Premium Quotation:

Stated in decimals. One point equals $100. The minimum tick for XSP options is 0.01 ($1.00) for all series, including LEAPS.

Exercise Style:

European – Mini-SPX Index options generally may be exercised only on the expiration date.

Last Trading Days:

The last trading day for Standard, Weekly and End-of-Month (EOM) XSP options is their expiration date. On their last trading day, trading in expiring XSP options closes at 4:00 p.m. ET.

Expiration Dates for Standard, Weekly and EOM Options:

Standard XSP options expire on the third Friday of the expiration month or the immediately preceding business day if the Exchange is not open on that Friday. XSP Weekly options expire on a Monday, Wednesday, or a Friday. If the Exchange is not open on a Wednesday or Friday, the normally expiring Wednesday or Friday Weekly will expire on the immediately preceding business day. If the Exchange is not open on a Monday, the normally expiring Monday XSP Weekly will expire on the first business day immediately following that Monday. EOM XSP options expire on the last business day of the expiration month.

Expiration Months:

Cboe may list up to six expiration months of XSP options at one time. Weekly options (End-of-Week, Wednesday Weekly), EOM options and LEAPS may also be listed.

Settlement of Option Exercise:

Exercise will result in delivery of cash on the business day following expiration. The exercise settlement value, XSP, is one-tenth (1/10th) the official closing price of the S&P 500 Index as reported by Standard & Poor’s on the last trading day of the expiring series. The exercise settlement amount is equal to the difference between the exercise-settlement value and the exercise price of the option, multiplied by $100.

Position Limit:

No position and exercise limits are in effect.

Margin:

Purchases of puts or calls with 9 months or less until expiration must be paid for in full. Writers of uncovered puts or calls must deposit / maintain 100% of the option proceeds* plus 15% of the aggregate contract value (current index level x $100) minus the amount by which the option is out-of-the-money, if any, subject to a minimum for calls of option proceeds* plus 10% of the aggregate contract value and a minimum for puts of option proceeds* plus 10% of the aggregate exercise price amount. (*For calculating maintenance margin, use option current market value instead of option proceeds.) Additional margin may be required pursuant to Exchange Rules 12.3(h) and 12.10.

CUSIP Number:

12505Q

XSP Trading Hours:

9:30 a.m. – 4:15 p.m. Eastern Time. On the last trading day, trading hours for expiring XSP standard, weekly and EOM options are 15 minutes shorter from 9:30 a.m. – 4:00 p.m. Eastern Time.