高风险期权风靡华尔街,一场潜在的股市风暴恐正在酝酿中。

如今,华尔街的交易员们正蜂拥而入一种“零日到期期权 (0DTEs) ”。顾名思义,这类期权的到期时间只剩下不到24小时,意味着它可以在短短几个小时内获得巨额回报,因此也被称为“像乐透彩票一样”。

然而,天上不会掉馅饼,这种期权带来高收益的同时,交易者也必须承担背后的巨大风险。摩根大通此前警告称,这种短期期权交易量的爆炸式增长可能造成与2018年初同一级别的市场灾难。

并且,0DTE只是衍生品市场的“冰山一角”,其潜在巨大风险所引爆的市场危机,将是人们无法想象的。在许多分析师看来,0DTE正在成为嵌入市场的定时炸弹,在华尔街的上空滴答作响。

什么是零日到期期权(0DTEs)?

零日到期期权 (0DTEs) 是在交易当天到期并失效的期权合约,这意味着期权的到期时间只剩下不到24小时。当期权到达这一阶段时,交易者并没有多少时间来买入或卖出标的资产,交易过程需要十分迅速。

交易员们通常将其视为一种针对经济数据发布和美联储会议等可能影响市场的事件进行策略性押注的方式。许多交易员十分青睐这种期权,因为到期前的最后一天是投资期权的最佳时机。他们有机会迅速利用头寸,并在短期内占用资金;在同一天进行交易和退出交易也消除了价格在一夜之间波动的风险。

交易量的飙升

随着0DTE的兴起,一些华尔街人士担心,标普500指数等规模最大、流动性最强的股票指数日益频繁地出现超大幅度的每日波动,这让美国股市变得更加动荡和脆弱。有人甚至担心,它们可能会导致市场崩盘,对市场稳定产生深远影响。

0DTE在2021年的模因股票(Meme Stocks)热潮中首先由散户交易员采用,在大型基金经理中广受欢迎。Meme Stocks 通常因炒作而定价过高,并在短时间内经历快速增长的峰值,如AMC、游戏驿站(GameStop)等。它们在千禧一代中很受欢迎,容易出现高波动性,估值基于潜力(话题性)而非财务状况。

根据芝加哥期权交易所全球市场(Cboe Global Markets)的数据,随着美国股市从去年1月的创纪录高点开始跌入熊市区间,与标普500指数挂钩的0DTE的日均交易量在2022年大幅飙升。

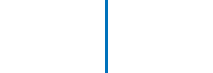

高盛的数据显示,去年第一季度,0DTE仅占Cboe标普500指数期权日均交易量的22.5%;而到去年第四季度末,这一比例已升至44%,几乎翻了一倍。芝加哥商品交易所(CME Group)股票指数产品全球主管 Paul Woolman 表示,在2023年初,0DTE的交易量仍在持续攀升。

(图片来源:高盛)

CME和Cboe为满足日益增长的需求,为一些最受欢迎的美国股指和ETF提供了每日到期的期权。CME的一位代表称,该交易所计划今年增加更多的每日到期期权。

CME高级副总裁兼衍生品和全球客户服务主管 Arianne Adams 表示,该交易所的客户一直希望增加更多的每日到期期权,因为这让交易员更具“战术性”,交易更“精确”。

“在压路机前捡硬币”

0DTE如此受欢迎的一个原因是,当利率逐渐走高时,在利率为零或接近零时的有效交易策略不再适用。去年,美股长期以来的涨势戛然而止,出现了更为剧烈的双向波动。因此,交易员们开始寻找新的投资方式。

交易员 Ernie Varitimos 经营着一个专门交易0DTE的Twitter账户,他向媒体表示,正是这种“不对称”风险吸引了他:

“这是一种可以以很小的风险换取很大回报的交易。”

从风险管理的角度来看,交易是一个相互的过程,风险也是两面的。当一个交易者买入期权时,另一个交易者卖出期权。期权购买者的损失是有上限的,因为在最坏的情况下,期权到期时毫无价值,购买者可以放弃行使期权,从而将损失限制在已支付的保费内。

而另一边,不进行风险对冲的期权卖出者面临的风险要高得多。看涨期权卖出者理论上面临的损失是没有上限的,因为相关资产的价格没有上限,而如果期权购买方执行期权,看跌期权卖出者也可能遭受重大损失。鉴于期权的风险是无限的,这给卖出期权的做市商和交易员带来了重大的风险管理问题。

野村证券跨资产策略和全球股票衍生品董事总经理 Charlie McElligott 在谈到出售这些期权的相关风险时表示:

“这就像在压路机前捡硬币。”

“波动性末日”(Volmageddon 2.0)

上周三,摩根大通首席市场策略师兼全球研究联席主管 Marko Kolanovic 警告称,短期期权交易正在呈爆炸式增长,并可能造成与2018年初同一级别的市场灾难——0DTE越来越受欢迎可能引发“Volmageddon 2.0”。

2018年2月,一个名为 VelocityShare Daily Inverse VIX Short Term ETN (XIV) 的追踪波动率基金,因为市场下跌至接近赎回线而遭到抛售,做市商在操作的同时推高了风险,引发“滚雪球”效应,并使这一产品最终遭到赎回。

这场危机导致道琼斯工业指数单日暴跌1175.21点,跌幅为4.6%,创下截至当时的历史最大单日跌幅;标普500指数在两周内大跌10%,被市场称为“波动性末日”(Volmageddon)。

Kolanovic 在报告中写道:

虽然历史不会重演,但它往往是押韵(即重复)的。这些每日和每周期权一旦卖出,将对市场产生类似的影响。

Kolanovic 的模型显示,0DTE的每日名义交易量目前约为1万亿美元。一旦市场出现大幅下跌,做市商被迫平仓引爆的危机,0DTE可能带来盘中300亿美元的卖盘规模。

(图片来源:摩根大通)

Kolanovic 指出,如果这些期权进入资金后出现大幅波动,而卖家无法支撑这些头寸,那么被迫回补将导致规模非常大的定向流动:“鉴于当前流动性较低的环境,这些资金流动可能对市场产生特别大的影响。”

正如 Kolanovic、McElligott等人解释的那样,0DTE的一个问题是其波动性非常大,这意味着标普500指数的小幅波动就可能使这些期权价值出现巨大波动——可以在几分钟内从毫无价值变为天价。

道琼斯市场数据公司的数据显示,去年标普500指数有122个日涨跌幅度均在1%或以上,为2008年以来最多,是20年平均水平65.6日的近两倍。这一趋势在2023年仍在持续——标普500指数今年以来已经出现了15次1%或以上的上下波动,这是自2016年以来年初最多的一次。

人们担心的是,如果美国股市出现特别剧烈和意外的波动,0DTE期权的交易量可能会破坏做市商们的风险对冲,导致市场突然出现闪电式的崩盘或波动性的螺旋式上升。

期权市场数据和分析提供商 OptionMetrics 的定量研究主管 Garrett DeSimone 向媒体表示:

我们还没有看到系统性风险出现,但有人担心,如果每天都有很大的波动,就像我们在2020年3月看到的那样,我们真的不知道做市机制会如何反应。

Are you ready to take your trading to the next level? The 0DTE strategy is your ticket to rapid profits and unmatched excitement. Say goodbye to waiting days for results – with this strategy, you can transform quick trades into substantial gains within a single day.

Why Choose the 0DTE Strategy?

- Lightning-Fast Wins: No more waiting around. Execute trades in the morning and cash in on profits by the end of the day. This strategy is tailor-made for those who thrive on quick action and instant gratification.

- Amplified Gains: The 0DTE strategy magnifies your gains through timely decision-making. Capitalize on intraday market movements and let your profits grow faster than you ever thought possible.

- Reduced Risk Exposure: Say goodbye to overnight risks that keep you up at night. With trades expiring on the same day, you’ll sleep soundly knowing that your investments won’t be at the mercy of after-hours surprises.

Getting Started: Your Path to Same-Day Success

- Simple Implementation: Don’t let the rapid pace intimidate you. Our step-by-step guide simplifies the process, ensuring that even novice traders can dive in with confidence.

- Trade Anytime, Anywhere: Embrace the flexibility of the 0DTE strategy. Whether you’re a full-time trader or balancing it with a day job, you can seize opportunities whenever they arise.

- Risk Management Made Easy: Worried about potential losses? Our proven risk management techniques empower you to safeguard your capital and minimize the impact of unfavorable trades.

Your Profit-Boosting Toolbox: Tips for Thriving in 0DTE Trading

- Educational Resources: Equip yourself with the latest insights and techniques through continuous learning. Navigate market shifts with expertise and stay ahead of the curve.

- Start Small, Win Big: Dip your toes by initiating trades with small positions. As you gain confidence, you can scale up your investments while keeping risk under control.

- Discipline for Success: Emotions can cloud your judgment. Stick to your pre-defined plan, and let strategy, not impulses, guide your trading decisions.

Don’t miss out on the immense potential of the 0DTE strategy. Elevate your trading game, make profits in minutes, and revel in the thrill of same-day success. It’s time to seize control of your financial journey and watch your gains soar. Get started now and experience the 0DTE advantage! 🚀📈

0DTE Options Strategy: A Guide for Traders

Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price and time. Options can be used for various purposes, such as hedging, speculation, income generation, or portfolio diversification.

One of the factors that affect the value of an option is time decay. Time decay is the decrease in the option’s price as it approaches its expiration date. The closer the option is to expiration, the faster it loses value due to time decay.

Some traders use a strategy called 0DTE options, which stands for zero days to expiration. This means that they buy or sell options on the same day that they expire. This strategy can be risky, but also potentially profitable, depending on the market conditions and the trader’s skill.

The main advantage of 0DTE options is that they are very cheap compared to longer-term options. This means that traders can use a small amount of capital to gain exposure to a large number of underlying assets. For example, if a stock is trading at $100 and a 0DTE call option with a strike price of $101 costs $0.01, then a trader can buy 100 contracts for $100 and control 10,000 shares of the stock.

The main disadvantage of 0DTE options is that they have a very low probability of success. Most of the time, the options will expire worthless or with minimal value, resulting in a loss for the trader. The trader needs to be very accurate in predicting the direction and magnitude of the price movement of the underlying asset in order to make a profit.

Another challenge of 0DTE options is that they are subject to high volatility and liquidity risk. Volatility is the measure of how much the price of an asset fluctuates over time. Liquidity is the measure of how easily an asset can be bought or sold without affecting its price. High volatility and low liquidity can make it difficult for traders to enter or exit their positions at favorable prices.

Therefore, 0DTE options are not suitable for beginners or risk-averse traders. They require a lot of experience, discipline, and market knowledge to execute successfully. Traders who use this strategy should have a clear trading plan, a strict risk management system, and a well-defined exit strategy.

0DTE options can be an exciting and rewarding way to trade options, but they also come with significant risks and challenges. Traders who are interested in this strategy should do their own research, practice on a demo account, and start with small positions until they gain confidence and skill.

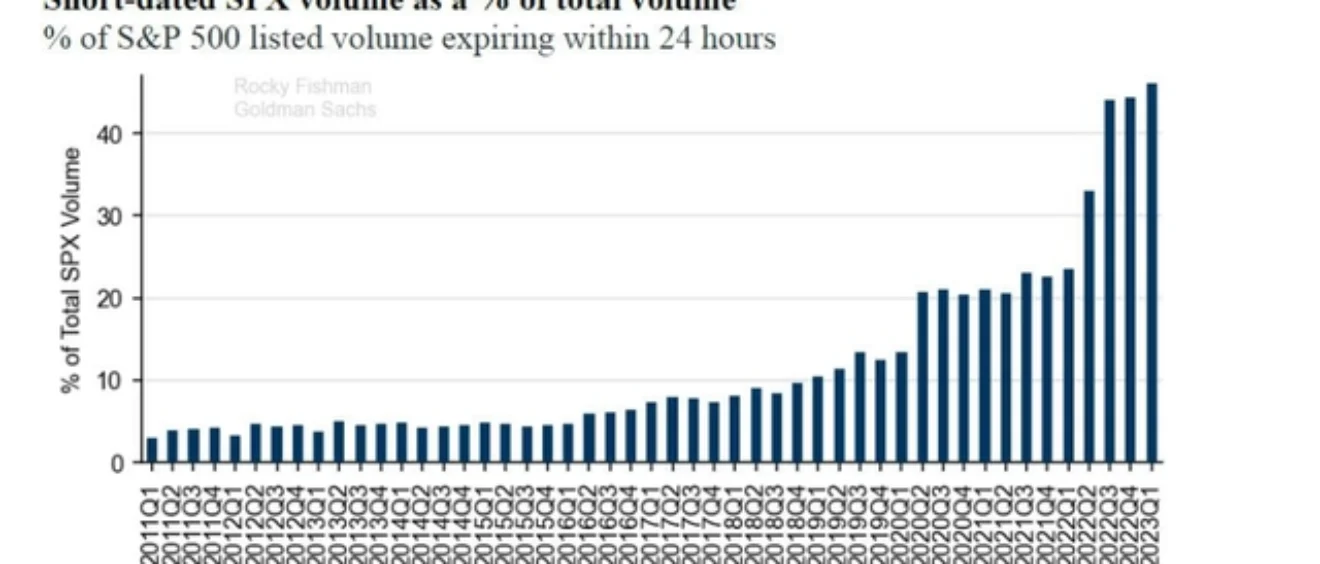

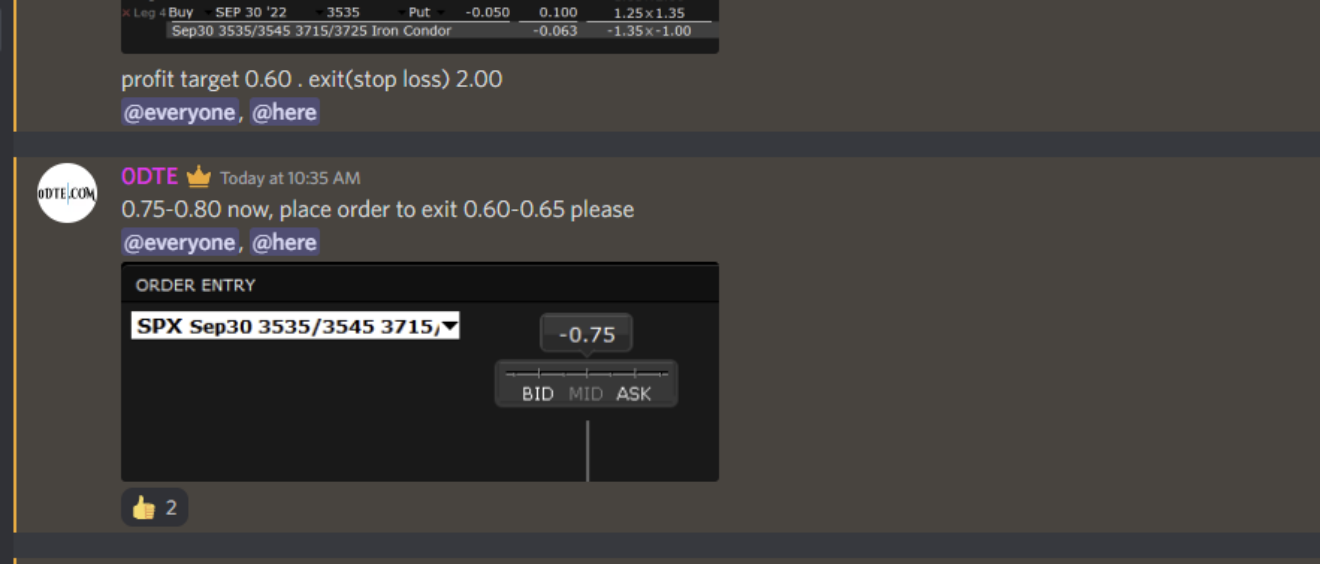

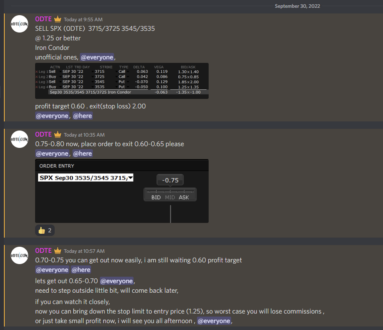

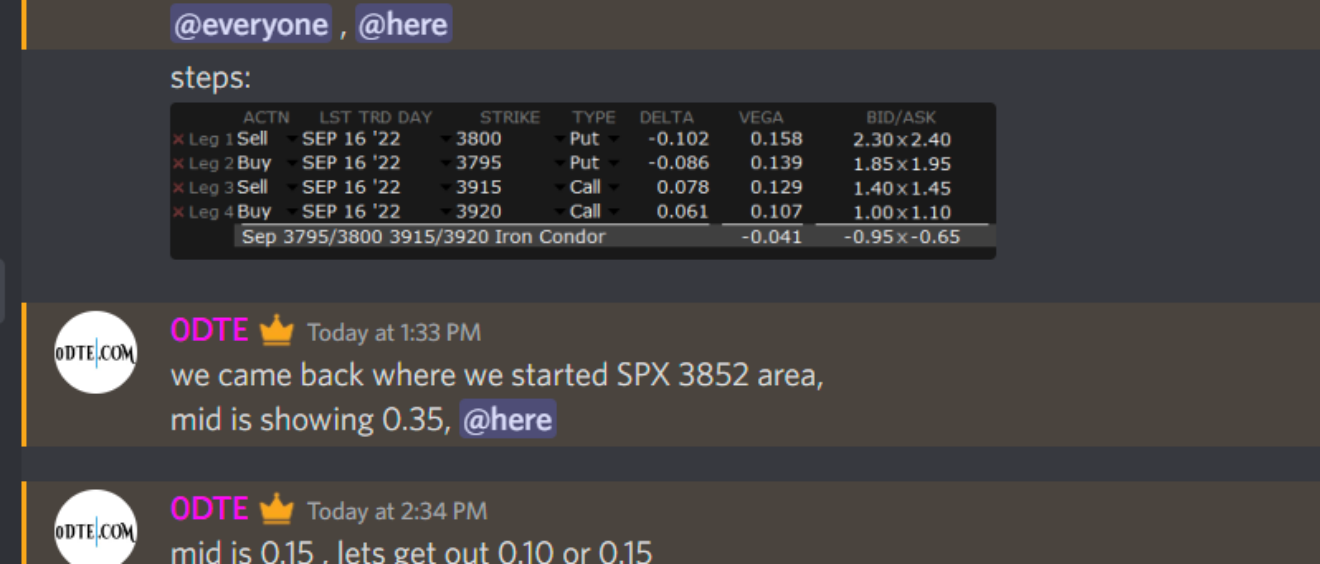

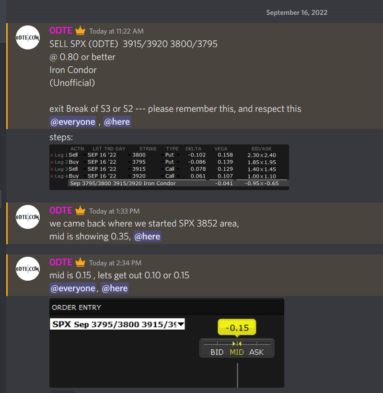

@ 1.25 or better

Iron Condor

Unofficial ones,

profit target 0.60 . exit(stop loss) 2.00

@everyone, @here

Out 0.65 . #0dte #spx #0dtebot #spx0DTE