Strategies

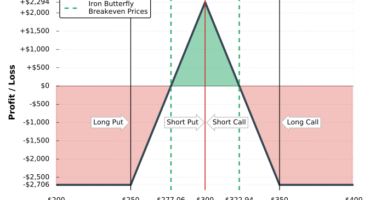

Jim Olson Iron Butterfly 0DTE Trade Plan

Iron Butterfly involves selling the ATM call and put and buying wings. Sell the Open in the first 1 minute. […]

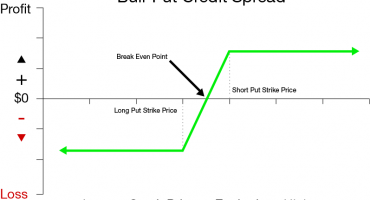

Read More ›Vertical Spread - 0 DTE

Vertical Spread Long Call Vertical Spread A long call vertical spread is a bullish, defined risk strategy made up of […]

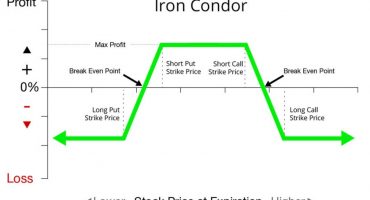

Read More ›Iron Condor - 0 DTE

Iron Condor An Iron Condor is a directionally neutral, defined risk strategy that profits from a stock trading in a […]

Read More ›0DTE Blogs

0DTE——华尔街在玩一种很新的东西,风险堪比“在压路机前捡硬币”

零日到期期权 (0DTEs) 是在交易当天到期并失效的期权合约,这意味着期权的到期时间只剩下不到24小时。当期权到达这一阶段时,交易者并没有多少时间来买入或卖出标的资产,交易过程需要十分迅速。 交易员们通常将其视为一种针对经济数据发布和美联储会议等可能影响市场的事件进行策略性押注的方式。许多交易员十分青睐这种期权,因为到期前的最后一天是投资期权的最佳时机。他们有机会迅速利用头寸,并在短期内占用资金;在同一天进行交易和退出交易也消除了价格在一夜之间波动的风险。

Read More ›0DTE Options Strategy: A Guide for Traders

0DTE Options Strategy: A Guide for Traders Options are contracts that give the buyer the right, but not the obligation, […]

Read More ›SPX 0DTE Trade Definitions

Credit: The net premium received when selling to open the credit spread. Credit = (Bidshort - Asklong) * 100 Max. Loss: […]

Read More ›S&P 500 Index Options - SPX

Cboe’s SPX® options products provide investors with the tools to gain efficient exposure to the U.S. equity market and execute risk […]

Read More ›Mini-SPX Index Options (XSP)

The Cboe Mini-SPX option contract, known by its symbol XSP, is an index option product designed to track the underlying […]

Read More ›SPX 0DTE strategy

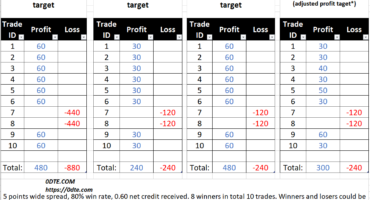

What is SPX 0DTE strategy? SPX weekly options that expire on every Monday, Wednesday and Friday we trade them on […]

Read More ›Videos

What to Know About Zero-Days-to-Expiration (0DTE) Options - Charles Schwab

What to Know About Zero-Days-to-Expiration (0DTE) Options - Charles Schwab Zero-days-to-expiration options have grown in popularity because of the potential for large, quick returns. We'll explore those factors driving interest in 0DTE options trading, as well as the risks, like rapid, large losses.

Read More ›