Vertical Spread

Long Call Vertical Spread

A long call vertical spread is a bullish, defined risk strategy made up of a long and short call at different strikes in the same expiration.

Directional Assumption: Bullish

Setup:

– Buy ITM Call

– Sell OTM Call

Ideal Implied Volatility Environment: Low

Max Profit: Distance Between Call Strikes – Net Debit Paid

How to Calculate Breakeven(s): Long Call Strike + Net Debit Paid

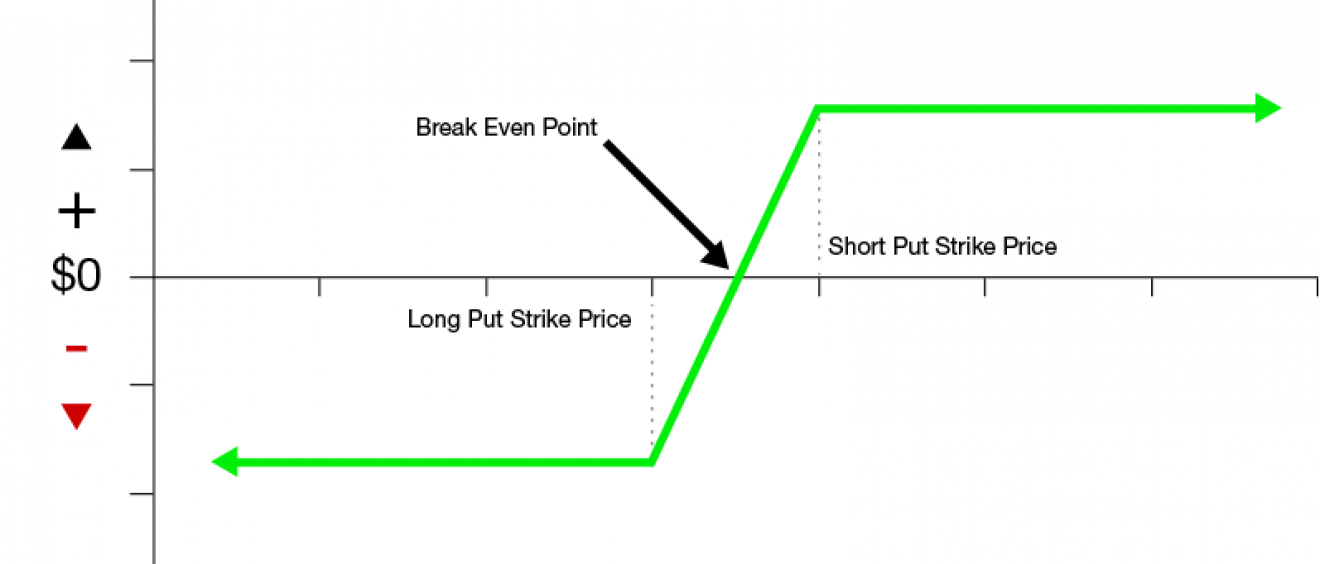

Long Put Vertical Spread

A long put vertical spread is a bearish, defined risk strategy made up of a long and short put at different strikes in the same expiration.

Directional Assumption: Bearish

Setup:

– Buy ITM Put

– Sell OTM Put

Ideal Implied Volatility Environment: Low

Max Profit: Distance Between Put Strikes – Net Debit Paid

How to Calculate Breakeven(s): Long Put Strike – Debit Paid

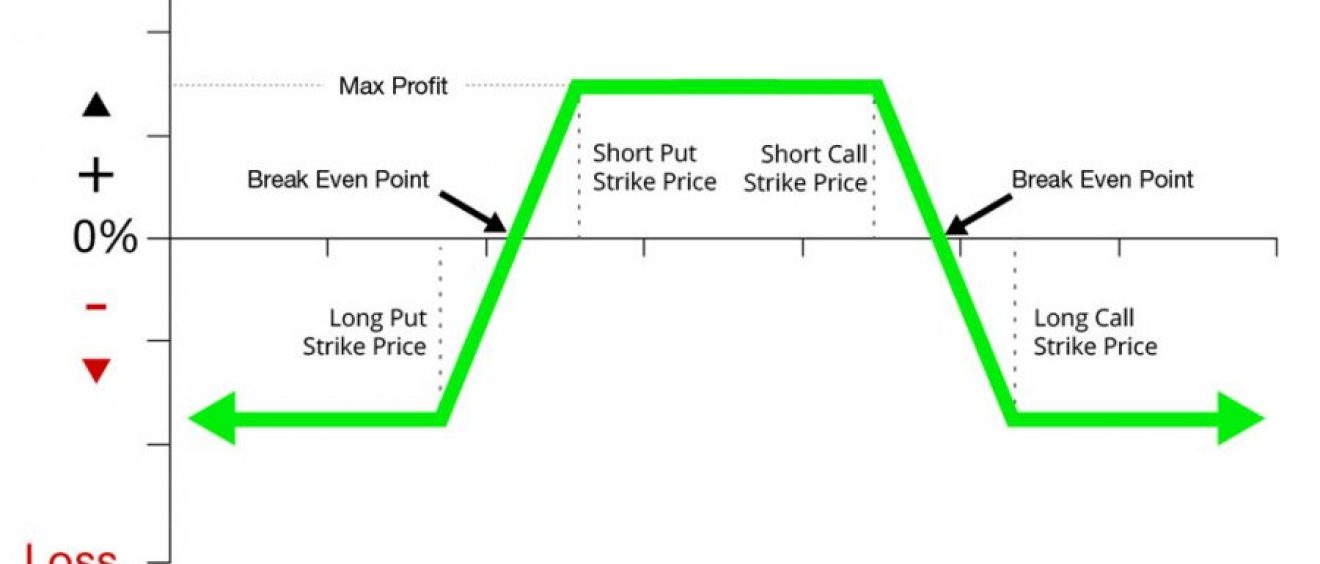

Short Call Vertical Spread

A short call vertical spread is a bearish, defined risk strategy made up of a long and short call at different strikes in the same expiration.

Directional Assumption: Bearish

Setup:

– Sell OTM Call (closer to ATM)

– Buy OTM Call (further away from ATM)

Ideal Implied Volatility Environment: High

Max Profit: Credit received from opening trade

How to Calculate Breakeven(s): Short call strike + credit received

Short Put Vertical Spread

A short put vertical spread is a bullish, defined risk strategy made up of a long and short put at different strikes in the same expiration.

Directional Assumption: Bullish

Setup:

– Sell OTM Put (closer to ATM)

– Buy OTM Put (further away from ATM)

Ideal Implied Volatility Environment: High

Max Profit: Credit received from opening trade

How to Calculate Breakeven(s): Short Put Strike – Credit Received

Vertical spreads allow us to trade directionally while clearly defining our maximum profit and maximum loss on entry (known as defined risk).

While implied volatility (IV) plays more of a role with naked options, it still does affect vertical spreads. We prefer to sell premium in high IV environments, and buy premium in low IV environments. When IV is high, we look to sell vertical spreads hoping for an IV contraction. When IV rank is low, we look to buy vertical spreads to stay engaged and also use it as a potential hedge against our short volatility risk.

Since the maximum loss is known at order entry, losing positions are generally not defended. We always look to roll for a credit in general, and doing so with vertical spreads is usually difficult.

tips:

When do we close vertical spreads?

Profitable vertical spreads will be closed at a more favorable price than the entry price (goal: 50% of maximum profit)

When do we manage vertical spreads?

Losing long vertical spreads will not be managed but can be closed any time before expiration to avoid assignment/fees.