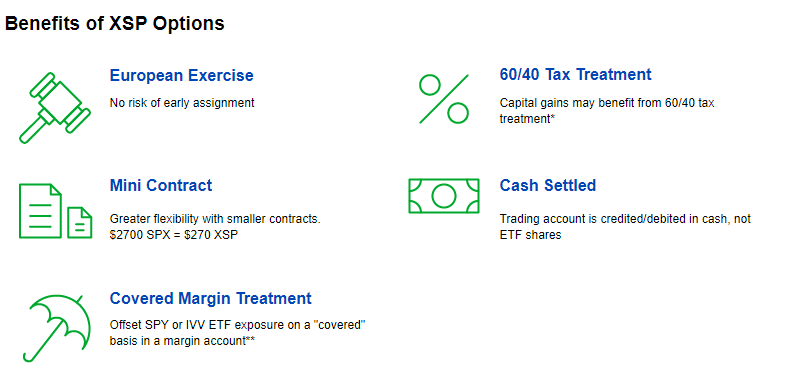

The Cboe Mini-SPX option contract, known by its symbol XSP, is an index option product designed to track the underlying S&P 500 Index. At 1/10 the size of the standard SPX options contract, XSP provides greater flexibility for new index options traders or traders managing an individual portfolio.

XSP Weekly Options

Whether it’s trading around specific events, such as earnings announcements or economic data reports, or executing overwriting or spread-trading strategies, Cboe XSP weekly options allow traders the granularity to more closely tailor their trades to meet their needs. And for traders executing premium collection strategies, XSP weekly options provide the opportunity to collect premium 52 times per year rather than 12.

XSP weekly options are offered with Monday, Wednesday, and Friday settlements. For Friday settlements, options contract expirations occur on non-standard Friday expirations throughout the year. Similarly, Monday and Wednesday XSP Weeklys options settlements may expire on any Monday or Wednesday of the month, other than a Monday or Wednesday that coincides with an end-of-month expiration date.

XSP Monday, Wednesday and Friday Weeklys options are typically listed on Friday, Tuesday and Thursday, respectively and will expire on their expiration date. If a standard or EOM options contract settlement exists in a week that coincides with a typical Weekly expiration date, a Weekly expiration will not exist on that expiration day. (The term Weeklys refers to the fact that the contracts are listed every week, not that they are a seven-day contract). Settlement processes for XSP weeklys are the same as their standard options counterparts (index, ETF, etc.).

Trading XSP

XSP options trade on Cboe’s Hybrid Trading System, which provides investors with the combined advantages of electronic trading and an open-outcry market on a single platform. XSP options also trade on the EDGX exchange.

XSP Options Product Specifications

Symbol: XSP

Underlying:

The Mini-SPX Index, based on 1/10th the value of the Standard & Poor’s 500 Index (SPX). The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks from a broad range of industries. The component stocks are weighted according to the total market value of their outstanding “free float” shares.

Multiplier:

$100.

Strike Price Intervals:

Generally, $1 or greater where the strike price is $200 or less and $5.00 or greater where the strike price is greater than $200. For XSP weekly contracts, the lowest strike price interval Cboe may list is $0.50.

Strike (Exercise) Prices:

In-, at- and out-of-the-money strike prices are initially listed. New strikes can be added as the index moves up or down.

Premium Quotation:

Stated in decimals. One point equals $100. The minimum tick for XSP options is 0.01 ($1.00) for all series, including LEAPS.

Exercise Style:

European – Mini-SPX Index options generally may be exercised only on the expiration date.

Last Trading Days:

The last trading day for Standard, Weekly and End-of-Month (EOM) XSP options is their expiration date. On their last trading day, trading in expiring XSP options closes at 4:00 p.m. ET.

Expiration Dates for Standard, Weekly and EOM Options:

Standard XSP options expire on the third Friday of the expiration month or the immediately preceding business day if the Exchange is not open on that Friday. XSP Weekly options expire on a Monday, Wednesday, or a Friday. If the Exchange is not open on a Wednesday or Friday, the normally expiring Wednesday or Friday Weekly will expire on the immediately preceding business day. If the Exchange is not open on a Monday, the normally expiring Monday XSP Weekly will expire on the first business day immediately following that Monday. EOM XSP options expire on the last business day of the expiration month.

Expiration Months:

Cboe may list up to six expiration months of XSP options at one time. Weekly options (End-of-Week, Wednesday Weekly), EOM options and LEAPS may also be listed.

Settlement of Option Exercise:

Exercise will result in delivery of cash on the business day following expiration. The exercise settlement value, XSP, is one-tenth (1/10th) the official closing price of the S&P 500 Index as reported by Standard & Poor’s on the last trading day of the expiring series. The exercise settlement amount is equal to the difference between the exercise-settlement value and the exercise price of the option, multiplied by $100.

Position Limit:

No position and exercise limits are in effect.

Margin:

Purchases of puts or calls with 9 months or less until expiration must be paid for in full. Writers of uncovered puts or calls must deposit / maintain 100% of the option proceeds* plus 15% of the aggregate contract value (current index level x $100) minus the amount by which the option is out-of-the-money, if any, subject to a minimum for calls of option proceeds* plus 10% of the aggregate contract value and a minimum for puts of option proceeds* plus 10% of the aggregate exercise price amount. (*For calculating maintenance margin, use option current market value instead of option proceeds.) Additional margin may be required pursuant to Exchange Rules 12.3(h) and 12.10.

CUSIP Number:

12505Q

XSP Trading Hours:

9:30 a.m. – 4:15 p.m. Eastern Time. On the last trading day, trading hours for expiring XSP standard, weekly and EOM options are 15 minutes shorter from 9:30 a.m. – 4:00 p.m. Eastern Time.