Today’s Trade 1:

SPX (0DTE) 4260/4265

@ 0.55

Out @ 0.15

Total: $40 profit per contract.

Traded on the main channel, TA based. (Daily Key Levels)

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/zlSCdJTKhX

Today’s Trade 1:

SPX (0DTE) 4260/4265

@ 0.55

Out @ 0.15

Total: $40 profit per contract.

Traded on the main channel, TA based. (Daily Key Levels)

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/zlSCdJTKhX

Today’s Trade 1:

SPX (0DTE) 4250/4260 4200/4190

@ 0.70

Out @ 0.20

Total: $50 profit per contract.

Unofficial Trade — Low IV

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/NIgaUjbVTj

Credit: The net premium received when selling to open the credit spread.

Credit = (Bidshortxa0- Asklong) * 100

Max. Loss: The risk and maximum loss of the credit spread, incurred if both legs expire in the money.

Max. Loss = (ABS(Strikeshortxa0- Strikelong) * 100) - Credit

R/R: The return-to-risk ratio of the credit spread.

R/R = Credit / Max. Loss

Prob. OTM: The approximate chance of the short leg option expiring out of the money and the full credit being retained.

Prob. OTM = (1 - N(d2short)) * 100

The main factors in the risk-neutral probability calculation for a credit spread are the underlying’s price relative to the short strike, the underlying’s volatility as implied by its near-term options, and the time remaining until expiration.

The drift factor of the formula is determined by the risk-free interest rate, and if applicable, the underlying’s dividend yield.

s = Underlying price.

k = Strike price.

t = Time remaining until expiration.

r = Continuously compounded risk-free interest rate.

q = Continuously compounded dividend yield.

v = Volatility.

N = Cumulative distribution function.

d2 = (LOG(s / (s + ABS(s - k))) + (t * (q - r - ((v ** 2) / 2)))) / (v * SQRT(t))

The model assumes random movement in the underlying without influence from catalytic events occurring before expiration, such as an earnings report or unexpected news. It reflects the expected moneyness at the time of expiration only, and not the probability of the short option moving into the money at least once before expiration and possibly being exercised.

If applicable, the underlying’s next estimated earnings report date is displayed in the row below.

(EV) Expected Value: The average credit retained per trade after factoring in expected losses.

Vertical credit spreads:

EV = (Credit * (1 - N(d2short))) - (Max. Loss * N(d2long)) - (MIN((ABS(Strikeshortxa0- Strikelong) * (1 / (1 + (N(d2short) / N(d2long))))) * 100, Max. Loss) * (N(d2short) - N(d2long)))

Diagonal credit spreads:

EV = (Credit * (1 - N(d2short))) - (Max. Loss * N(d2long)) - ((MIN((ABS(Strikeshortxa0- Strikelong) * (1 / (1 + (N(d2short) / N(d2long))))) * 100, Max. Loss) - expected extrinsic value of long leg at short expiration) * (N(d2short) - N(d2long)))

This interpolation is the sum of the results of a credit spread’s three possible outcomes.

For vertical credit spreads in this situation which aren’t comprised of cash-settled index options, additional losses could occur due to pin risk since the hedging long leg has expired worthless. To mitigate this risk, close positions that are near the money at expiration.

The expected value for diagonal credit spreads in this situation benefits from the remaining time value of the long leg offsetting the cost of the short leg’s exercise.

A positive expected value indicates a statistical edge and profitability over time, meaning enough credit is collected on each iteration of the trade to offset its potential losses excluding commissions.

(ER) Expected Return: The expected value per trade relative to the capital risked.

ER = (EV / Max. Loss) * 100

(AER) Annualized Expected Return: The expected return with respect to the time remaining until expiration, representing the capital efficiency of the trade.

AER = (((1 + (ER / 100)) ^ (1 / (business days until expiration / 252))) - 1) * 100

(POP) Probability Of Profit: The approximate chance of the underlying price being at least $0.01 away from the break-even price of the credit spread at expiration.

Call credit spreads:

POP = (1 - N(d2breakeven)) * 100

Put credit spreads:

POP = (1 - N(-d2breakeven)) * 100

(BE) Breakeven: The break-even price of the credit spread.

Call credit spreads:

BE = Strikeshortxa0+ Net

Put credit spreads:

BE = Strikeshortxa0- Net

Net: The market price of the credit spread.

Net = Bidshortxa0- Asklong

Bid: The bid price of the short leg option.

Ask: The ask price of the long leg option.

(IVP) Implied Volatility Percentile: The percentage of days over the past year when the underlying had a 30-day implied volatility value lower than its current level.

(IVR) Implied Volatility Rank: The underlying’s current 30-day implied volatility relative to its highest and lowest levels over the past year.

(IVSP) Implied Volatility Skew Percentile: The percentage of days over the past six calendar months when the underlying had a 30-day implied volatility skew lower than its current level. This is a comparative measure of investors’ directional sentiment and is derived from the underlying’s ratio of OTM and ITM implied volatility.

The sentiment is displayed in the row below, with percentiles 0-39, 40-59, and 60-99 representing a bullish, neutral, and bearish outlook respectively.

To the right of the sentiment is the time since the underlying’s options were scanned, representing the age of the data. Hover to reveal the exact time of the last update.

Today’s Trade 2-3:

SPX (0DTE) 4230/4240 4230/4220

@ 7.50

Out @ 7.80

Total: $30 loss per contract.

SPX (0DTE) 4225/4235 4225/4215

@ 6.80

Out @ 5.30

Total: $150 profit per contract.

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/iRXyiDfBCF

Today’s Trade 1:

Unofficial Trade Alerts:

SPX (0DTE) 4250/4260 4205/4195

@ 0.75

Out @ 0.65

Total: $10 profit per contract.

Based on TA(Technical Analysis).

Closed the Put Side, let Call side expire.

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/8E9oQL18SV

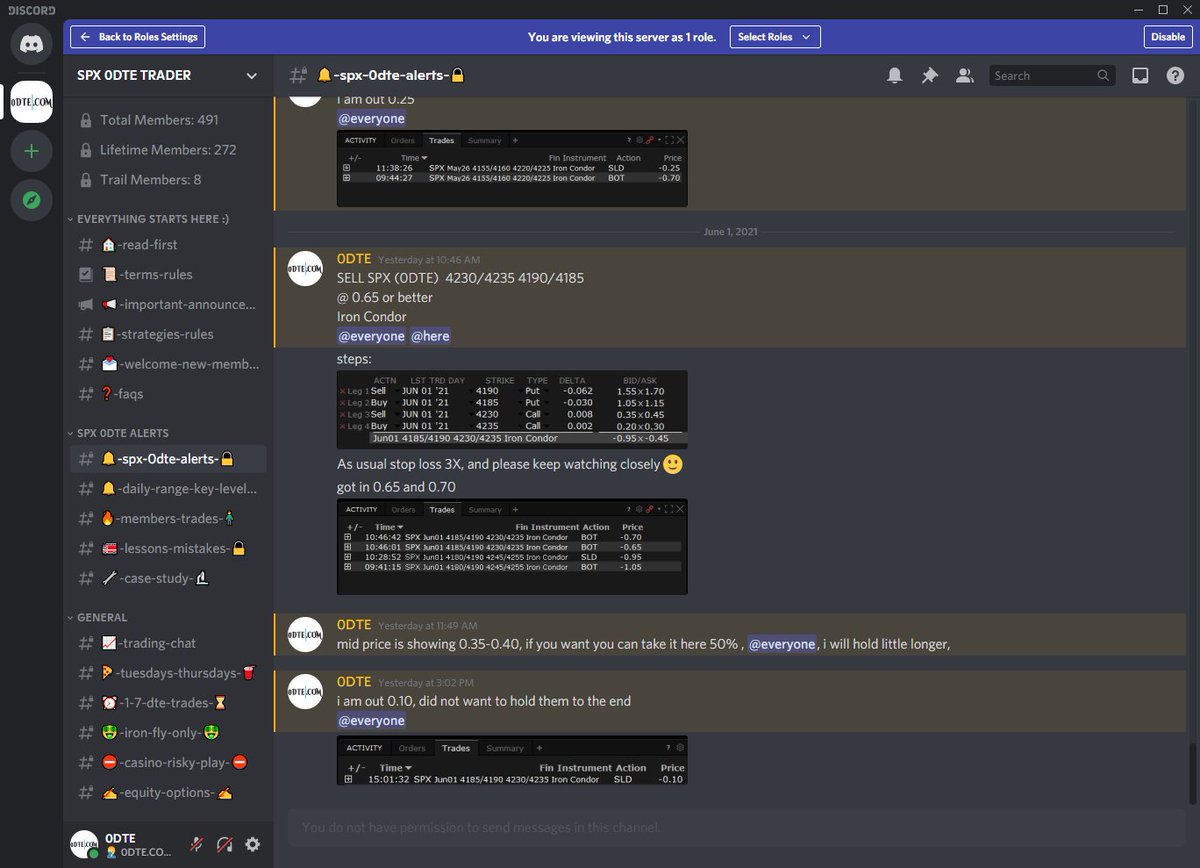

Take a sneak peek at our private Discord Channel 😊

Details: https://t.co/u1ZeGihcvz

*As of June 1, 2021

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/oCdYoZ19Pw

Today’s Trade 1:

SPX (0DTE) 4235/4245 4185/4175

@ 0.85

Out @ 0.35

Total: $50 profit per contract.

Unofficial Trade Alerts. 🙂

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/bZgfJh5ADd

Today’s Trade 1:

SPX (0DTE) 4230/4235 4190/4185

@ 0.65 @ 0.70

Out @ 0.10

Total: $57.5 profit per contract.

Today’s Trade 2:

SPX (0DTE) 4245/4255 4190/4180

@ 1.05

Out @ 0.95

Total: $10 Profit per contract.

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/l0RvFLbsKB

Today’s Trade 2:

XSP (0DTE) 419/421 419/417 Iron Fly

@ 0.96

2 points spread. Max Risk: 104. (200-96)

Cash settled for $36 profit (96-59.99).

SPX closed 4195.99.

XSP for those who have the smaller account size,

with XSP we can do as little as 1 point spread for $100 margin. https://t.co/WEXD8ninV9

Today’s Trade 1:

SPX (0DTE) 4220/4225 4160/4155

@ 0.70

Out @ 0.25

Total: $45 Profit per contract.

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/6PLAThU1at

Today’s Trade 1:

SPX (0DTE) 4215/4225 4155/4145

@ 0.90

Out @ 0.45

Total: $45 profit per contract.

Today’s Trade 2:

SPX (0DTE) 4205/4200/4195 Butter Fly Put

@ 0.75

Out @ 1.20

Total: $45 Profit per contract.

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/bzUAWe77q8

Today’s Trade 3:

SPX (0DTE) 4200/4205/4210 Butter Fly Call

@ 0.50

Out @ 0.75

Total: $25 profit.

Today’s Trade 4:

SPX (0DTE) 4200/4205 4200/4195 IronFly

@ 4.10

Expired, SPX closed near 4197

Est.$110 profit.

#SPX #SPY #SP500 $SPX #ES_F $ES_F #0dte #dailyincome #options #ES https://t.co/j20nZQ9ydy